The Cashout: Do Online Casinos Hurt Land-Based Casinos?

TCL will offer market analysis in the US gambling space in The Cashout every Friday. The weekly post will focus on metrics in the US market as well as regulatory and legal developments as events warrant. I think this topic is important, so this week, The Cashout is for all subscribers, paid and free.

We are getting a new round of hand-wringing and fear-mongering that online casino hurts land-based casinos of late. The newest wave was triggered by Las Vegas Sands CEO Rob Goldstein saying he was worried about bidding on a retail casino in New York because of the prospect of online casino becoming legal in the future. Online casino, he argues, would hurt any investment in a retail casino.

The only concern I have these days is the ongoing strength of online gambling. You can’t ignore what’s happening in New Jersey, Pennsylvania, and Michigan. … There has to be some way to think about the online impact, no matter where you are in the U.S. I’ve been looking at it closely. I would love to be in New York with the right capital structure and right licensure process. This is the newest wrinkle. My personal thinking has been influenced somewhat by the last six months of the growth of online gambling.

More here.

This debate has been going on for more than a decade, ever since New Jersey legalized online casino. But as we sit here in 2024, we’re getting decidedly more data. And that data is not pointing to online casino being a major problem for land-based revenue.

So since Goldstein said New Jersey, Pennsylvania and Michigan give him pause, let’s see what the data says about those three states. In two of them, it seems pretty clear that online casino isn’t hurting. And in the other, the data is a bit murkier but is still far from an indictment of online casino.

Gambling Industry Reverse Job Board | If you’re hiring or looking for freelance help, check out the job seeker board/resource I have created and hosted at Closing Line Consulting. There are 100 folks listed and looking for work so far. If you can share it with your HR or talent acquisition folks, it would be much appreciated. If you’re looking for work or know someone who is, there’s a form you can fill out to be included in the listing.

Before we get into the data, a few caveats:

Covid happened in the middle of a lot of this, so we have wonky data for that period. But the periods before and after give us a pretty good look at the trend lines.

Online casino is admittedly just one factor in a complicated picture for the states and casino companies operating in them. Still, if we are saying “online gambling is bad for retail,” one would expect to see retail get hurt across the board, and for it to get worse over time.

I am not including sports betting revenue, which all three states added in recent years.

Most land-based casinos generally benefit from online casino from market-access agreements, and sometimes directly if the parent company is also an online operator. While there are haves and have-nots, online casino is far from a zero-sum game for companies in any given state.

New Jersey

New Jersey is where online casino started in the US, so there’s no better place to start looking at the data. Here is New Jersey retail vs. online revenue since 2015:

Online casino launched earlier than this, but we can see a pretty steady upward trend line for retail and online. Then online casino started taking off during the pandemic and has continued growing since.

What you’ll notice is that land-based casino revenue has not suffered, and in fact grew after online casino started reaching a critical mass in 2020 and 2021. We can even see retail growing pre-pandemic alongside online.

Retail casino revenue in 2019: $2.69 billion. By last year, that number had reached $2.85 billion. For 2024 so far, retail casino is down slightly, but very slightly. In any event, that small pull-back could be due to any number of things, and it seems unlikely that it has anything to do with online.

It’s worth pointing out: ONLINE CASINO IS ADDING ALMOST $2 BILLION IN REVENUE A YEAR. That money is new money; absent online casino there is not some pent-up demand to add this kind of revenue to retail casinos. So any argument that says NJ online casino has been anything but a net win for the gaming industry as a whole (again, yes, there are winners and losers) is making a bad-faith argument.

So New Jersey tells a pretty compelling story. Online casino is creating a huge vertical on its own, while retail casinos aren’t suffering at all and are in fact growing on a GGR basis.

Closing Line Consulting

Need help with gambling content, navigating the North American gaming industry, communications/PR, or research and analysis? I have a consultancy to help in gaming and beyond. Reach out if you want to have a conversation. Learn more about CLC here.

The Closing Line is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

Pennsylvania

Let’s move over to Pennsylvania, which has had online casino since 2019.

If you break it down, you see a pretty similar story. Pre-pandemic, retail grew slightly but was actually pretty flat. PA launched its first online casinos in 2019 and more started launching in 2020.

Again, throw out the pandemic-influenced years and we see retail casino improving. Retail in the fiscal year ending in 2019: $3.26 billion. FY ending in 2021: $3.43 billion. Not astronomical growth, but it’s more growth than PA saw 2015-2019 combined.

Again, yes we’ve seen a plateau in the last three years of retail casino, but it’s certainly far from a pullback. And again, we’ve added almost $2 billion in revenue ON TOP of retail casinos. Hard to paint any of that as a net negative.

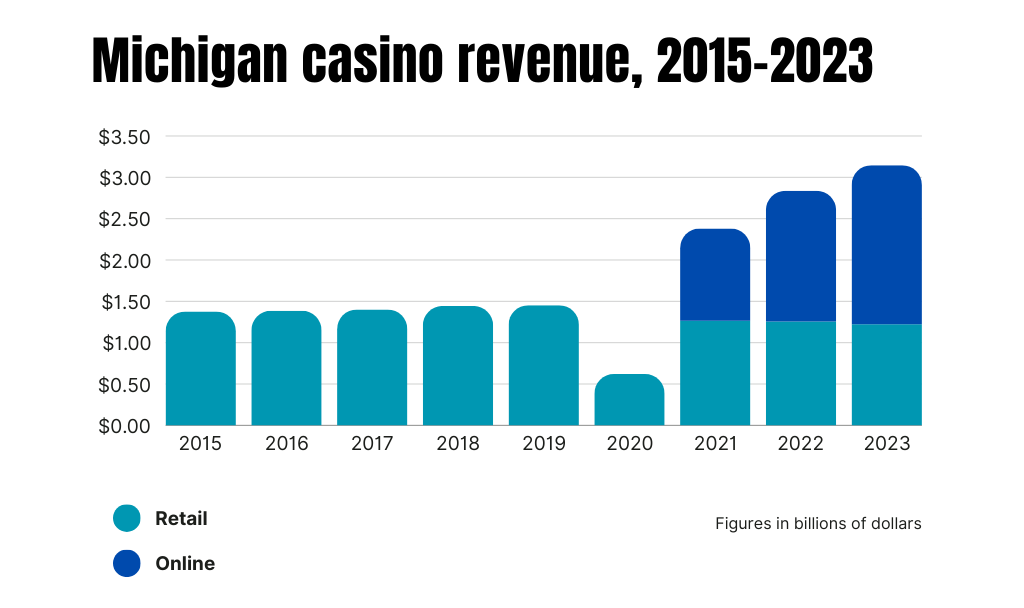

Michigan

So I warned you at the top, there’s a bit of bad data, and it comes from Michigan. I’d still argue it’s not really a bad narrative for online casino, it’s just not as clear-cut as a tailwind as it is in the previous two states.

It’s important to note this is just the revenue of the three Detroit commercial casinos; there’s no comparable data for the state’s tribal casinos (more on that in a bit).

The story can be told like this: steady growth 2015-2019, the pandemic, the launch of online casino in January of 2021 and then a pullback in retail. Land-based casinos generated $1.46 billion in 2019, but then $1.27 billion in 2021 and a slightly decreasing amount ever since. (I will note that retail casino in 2024 is trending slightly ahead of last year, with revenue reported through September).

So you can draw a fairly direct line between the launch of online casino and retail declining slightly The macro of Detroit and its casinos is also a contributing factor here; visits to the city are down since 2019.

But still, we can’t make a clear-cut observation that online casino isn’t taking away from retail.

But here are a few other points worth considering.

Two of the Detroit casinos (Hollywood and MGM Grand) are owned by online casino operators. They are again getting a huge chunk of the almost $2 billion in new GGR in the state. That $200 million in lost retail — even if we wanted to attribute all of it to the presence of online casino — is easily worth that tradeoff. The third casino, Motor City, has a partnership with FanDuel, so they are doing fine as well.

Then there are the tribal casinos, which are a little harder to know how they perform as a group. (Tribes can also partner with online casinos, for what it’s worth.) But we do see annual payments that they are obligated to make to local jurisdictions based on their net casino revenue (see the graph below). These payments were up in 2021 (the first year of online casino) vs. 2019, meaning we’d believe the tribal casinos weren’t experiencing a decline in their retail numbers. The payments in 2022 and 2023 were down vs. 2019 but still higher than figures 2018 and earlier.

And once again, let’s not lose sight of this: Online casino is creating a ton of new GGR that isn’t magically going to come from retail. Even if we believe it’s responsible for a small step back for retail, which is debatable, it’s also helping those same retail casinos, and we don’t have evidence that tribal casinos are being hurt in parallel.

Is cannibalization happening?

So, if you were painting a picture that online casino isn’t great for retail, you’d definitely start with Michigan to make that argument.

But in Pennsylvania and New Jersey we can definitively say from data in recent years that retail is holding its own while online casino creates new opportunities that wouldn’t exist in a retail-only environment.

If you want way more detail than I have gone into here, you can check out a study from iDEA Growth and Eilers & Krejcik Gaming. But here I tried to keep it as simple as possible to paint the picture that online casino isn’t the bogeyman if you are a retail casino. And it’s disappointing to see Las Vegas Sands perpetuating a false narrative that has little data to back it up.

For sponsorship inquiries, email dustin@closinglineconsulting.com.