The hot takes about the Penn/ESPN/Barstool news have been flowing like lava since last week’s news dropped.

If you happen to be living under a rock, here’s the news. The quick summary:

Penn Entertainment is paying ESPN a lot of money to license the brand as ESPN Bet for an online sportsbook.

Barstool Sportsbook is dead, and the media operation went back to Dave Portnoy.

So far, everyone has been largely focused on the future of ESPN Bet as a brand that will try to compete in the upper echelons of the US industry, and rightly so. I’ll eventually share my thoughts on the ESPN part of this deal in a future Substack, but I want to start with a look back at one of the bigger failures to date in the US sports betting space.

And let’s be clear this was a failure. Penn completed the full acquisition of Barstool earlier this year, and is now writing off $800-$850 million in losses in shuttering the brand. Penn sold Barstool back to Portnoy for some non-compete assurances and 50% of a future sale; he promptly said he would never sell. That’s a tremendous amount of value that Penn lit on fire.

Try to read any of this press release from February of THIS YEAR without laughing your ass off in light of the present. Here’s CEO Jay Snowden (emphasis mine):

“Barstool is a proven, powerful media brand with an authentic voice and vast, loyal audience that provides us with a strong top of funnel for new customer acquisition and organic cross-selling opportunities across our growing interactive division.”

At this point, it’s clear no one believes that, and I kind of doubt anyone believed it in February either. The only thing that’s happened between then and now was the launch of Barstool Sportsbook in its home state of Massachusetts in March.

To be fair, that could have set off alarm bells. Massachusetts is Barstool’s home state, and there was a feeling that it would at least outperform its 4-5% of share in the rest of the country. After opening in MA with about 6% of the market in terms of revenue, it fell back to less than 4% in succeeding months.

And that I guess was the realization: This wasn't working. Barstool had a ceiling of 5% of the market, unless someone was prepared to make some massive changes on how this was all going to work. And apparently, instead of investing in massive change with an uncertain outcome, or just be happy with 3-4% share, Penn decided to cut its losses and move on.

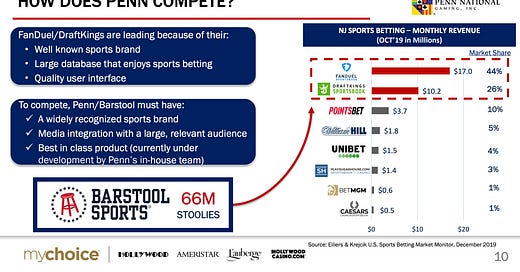

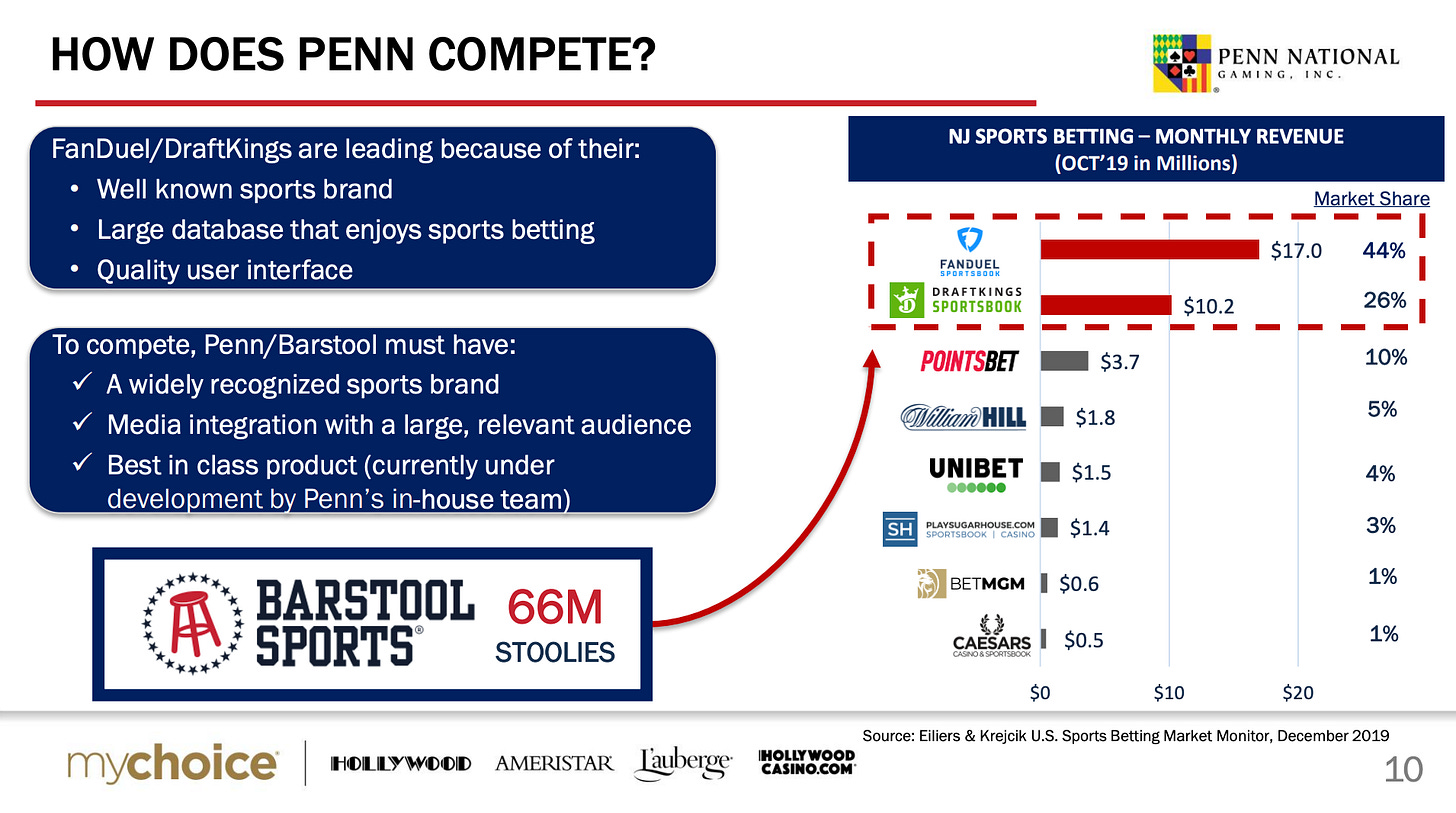

Here was what Penn was selling us when it made the minority acquisition of Barstool in 2020:

Spoiler alert, they got nowhere near the top two. Not only were they not competing with FanDuel and DraftKings, they weren’t competing for 3 and 4 with BetMGM and Caesars. And there was no real path to get there. (Penn is of course saying again that it’s aiming for the the podium with ESPN, and it at least has a fighting chance to get there.)

Whose fault is all of this? We’ll probably not know any time soon or ever, as the split between Penn and Barstool is amicable. Everyone is saying very nice things about each other as the door slams on the way out.

That Barstool and its personalities were a poor choice for the regulated gambling market is obvious in retrospect, and many of us were saying this since Day One. But it’s also a convenient excuse for the failure of the Penn/Barstool mashup.

Here’s what it comes down to: Barstool the brand and the media empire was supposed to be a great funnel for new/valuable/sticky customers, like Snowden said in February. And it’s clear now that it wasn’t terribly good at providing any of those (or at least not good enough to put it into a spot where it could sniff the top four operators.)

Was some of it because Barstool lost its “edge” because it was now part of a regulated industry? I don’t really buy that. Numbers for BarstoolSports.com (not podcasts, etc.) in the Penn era were down from pre-acquisition, but they are also in line with traffic before a giant 2019 spike that normalized, along with perhaps some of the excitement around sports betting and the Penn/Barstool tie-up. Here are visits per month:

Meanwhile, “Pardon My Take,” Barstool’s most popular podcast, is still usually on or near the top of the sports podcasts charts. High Noon, promoted by Barstool and Portnoy, has become one of the best-selling seltzer brands in the country over the past few years.

The “throttled” Barstool (was it really, though?) was still delivering tons of eyeballs, and capable of driving users to a product in meaningful numbers. The sum of it all doesn’t really depict an en masse departure from the brand and its resonance with fans that doomed the sportsbook.

(Quick aside: Whatever you think of Barstool, it’s pretty good at getting people to consume content. But I never really saw Barstool trying to create or retain new bettors with its written content on the website. Forget social media, podcasts and livestreams; it boggled my mind that a high-authority domain in search-engine land was not trying very hard. I am not sure how much value Barstool missed out on, but it was more than nothing.)

ESPN is certainly orders of magnitude better than Barstool as a brand and a potential source of new users. The floor for ESPN Bet is probably five percent, and the ceiling is much higher. That, coupled with the failure to realize the promise of three years ago, is why we’re now reading obituaries about Barstool Sportsbook.

The Closing Line is a publication of +More Media.

For sponsorship inquiries, email scott@andmore.media.

Another solid piece in the gaming space. Only thing missing is the Semisonic song playing in the background:

“Closing time, every new beginning

Comes from some other beginning's end, yeah

I know who I want to take me home…”