The Monday Line: Super Bowl Betting Data, ESPN Bet Numbers, PrizePicks Out Of NY

Here’s today’s quick rundown in the world of US gambling. Read The Friday Line if you’re playing catch-up.

Post-Super Bowl data

As we ease into the post-football months after the Super Bowl, there’s some data to dig into this morning.

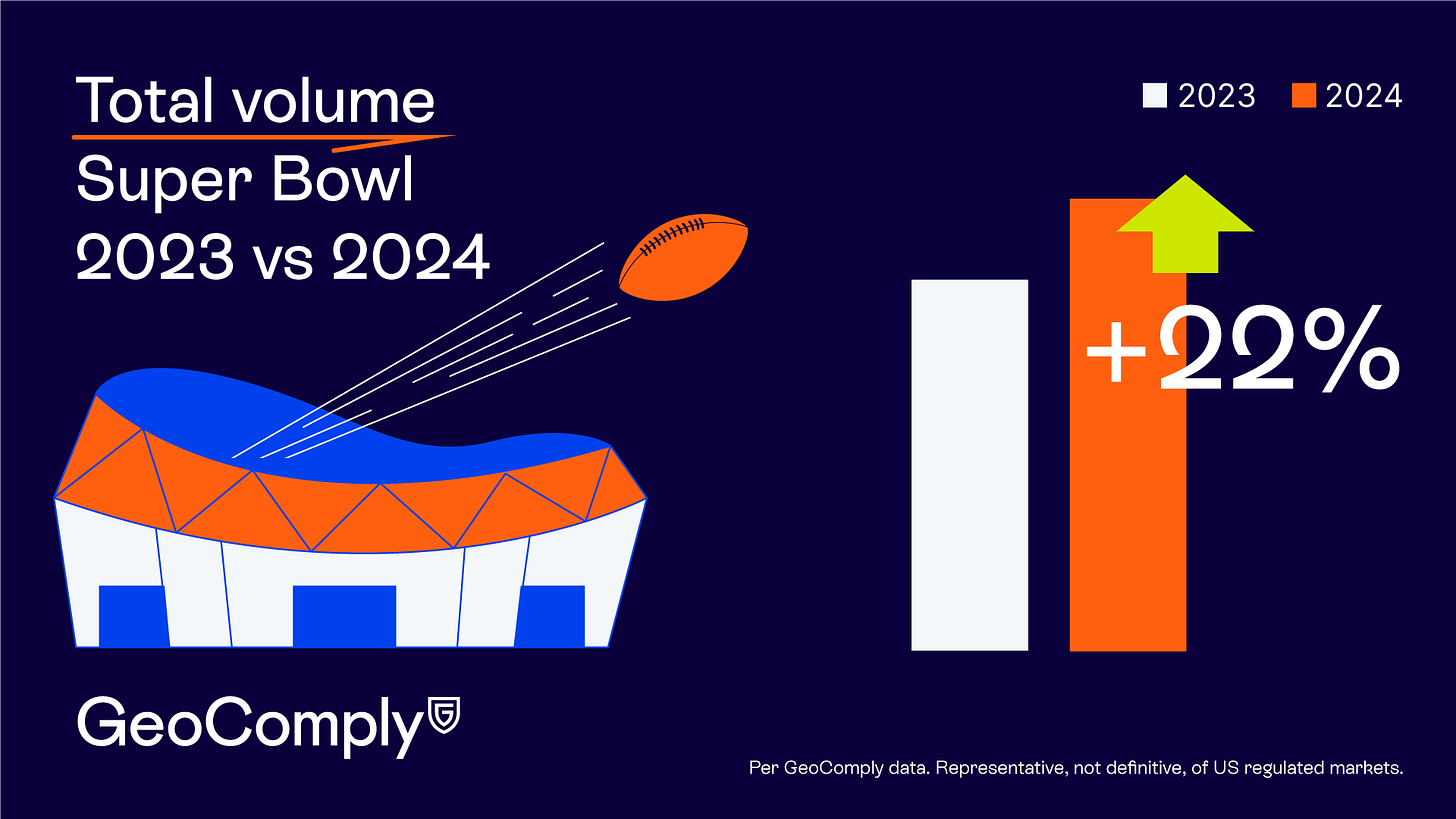

Geocomply, which works with almost all of the major sportsbooks, released several data points, including that geolocation checks were up 22% year over year around the Super Bowl. That figure does not include bettors in Florida on the Hard Rock Sportsbook app. Geolocation checks directionally tell us how much sports betting activity is taking place. There were also about 1.8 million new users, again not including Florida.

Here’s Eilers & Krejcik on app downloads around the Super Bowl. And here’s my much more anecdotal look at the market. My top-line takeaways are 1. continued dominance by FanDuel and DraftKings, 2. PrizePicks is probably in the conversation as the No. 3 operator when considering a blended sports betting/fantasy sports industry; and 3. Hard Rock is crushing it with its monopoly in Florida.

Want to sponsor The Closing Line newsletter? Feel free to reach out by emailing me via Substack or at dustin@closinglineconsulting.com.

Reading more tea leaves on ESPN Bet

The first January numbers for sports betting handle and activity are out. It’s a mixed bag and not a ton of movement as we try to divine how the rebooted Barstool Sportsbook is doing from a sampling of reports in the biggest states:

In Maryland, ESPN Bet accounted for roughly 7% of online sports betting handle in January, down a bit from December. Promo spend here (and likely elsewhere) was down significantly, so treading water isn’t necessarily bad viewed through that lens. It’s still well behind FanDuel and DraftKings and sits in fourth behind BetMGM. Revenue after promos was less than a million dollars.

It was a similar story in Iowa, where ESPN Bet was under 7% market share by handle, this time fourth well behind Caesars and just ahead of BetMGM. Net revenue was $75,000.

More of the same in Indiana: under 7% market share, behind BetMGM and ahead of Caesars.

If you’re glass half-full, spending less on promotions while maintaining market share is a positive (although you would expect more revenue in that scenario). If you’re glass half-empty, you’re starting to question where growth will come from and why ESPN isn’t terribly close to approaching 10% of the market after the tailwinds of the rebrand/relaunch.

Also of note: the Barstool deal with DraftKings was announced officially now that the Super Bowl is over; my take on that previously here.

PrizePicks + New York

PrizePicks is the largest fantasy sports vs. the house/fantasy parlay operator in the known universe*. That makes its departure from New York for real-money games notable, several months after the state gaming commission adopted a rule that would not allow fantasy vs. the house operators without a sports betting license. PrizePicks is still offering a free-to-play game. As of today, it appears some other operators still serve New York; Sleeper pulled out in October. Cease and desist letters from Florida’s regulator still hang over the industry as well. Here’s a rundown of the legality of fantasy sports vs. the house around the country along with a handy map.

*Currently unknown if anyone in Alpha Centauri offers pick’em DFS.

Closing Line Consulting

Need help with gambling content, communications/PR, or research and analysis? I’m formally starting a consultancy to help companies in the gaming industry and beyond Reach out if you want to have a conversation. Learn more about CLC here.

The Closing Line is a publication of +More Media.

For sponsorship inquiries, contact me or email scott@andmore.media.