The Current: The Story Behind Sports Betting App Downloads

Gambling news roundup: Entain CEO is out; Google updates its gambling advertising policy

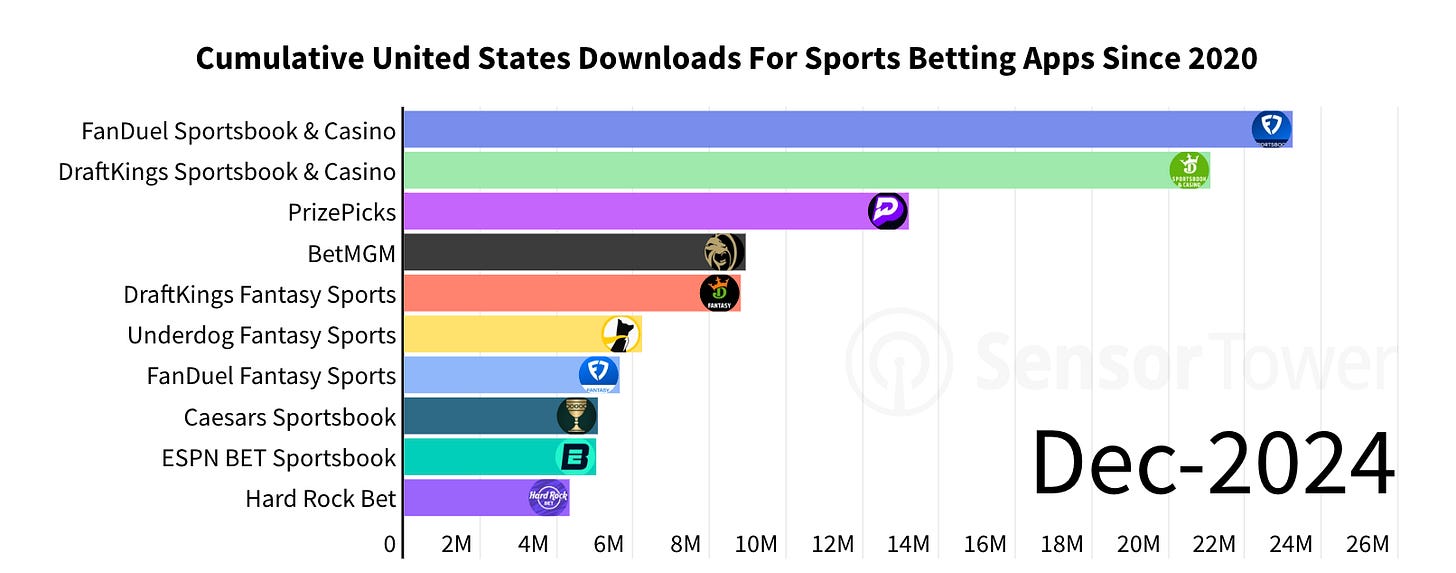

New data from Sensor Tower shows the story of the growth of legal US sports betting (and daily fantasy sports, for that matter).

The State of Mobile 2025 report goes into data across the mobile ecosystem, but it spends some time dedicated to gambling.

Some of the top-line data for the past five years will shock no one, but it’s still worth digging into:

it’s FanDuel and DraftKings by a mile, especially when you blend the fantasy app data with sports betting downloads.

DraftKings is now crushing FanDuel in downloads of their respective fantasy apps

PrizePicks is a clear No. 3 because it was an early mover in daily fantasy pick’em/parlays and because it can serve more states than sports betting apps.

BetMGM is a clear No. 3 in just the sports betting space.

NEXT.io New York is just a month away

Experience the foremost online gambling and sports betting summit in North America hosting 1,200 executives: Connecting operators with suppliers and start-ups with investors.

Sign up to attend here; Closing Line readers can use promo code N3W5L3TNY to save $100 on an event pass.

If you get the report, the above chart shows a very nice visualization that gives even more context than the static one above. We also learn that Underdog (fantasy pick’em) and Hard Rock (by virtue of its monopoly in Florida) were in the top 10 for most downloaded sports apps in 2024.

I got into the most recent data from early 2025 from Sensor Data on Friday (paywall), where we can see PrizePicks and Underdog are challenging DraftKings and FanDuel, at least in app downloads.

The ESPN Bet conundrum

Interestingly, there is a page dedicated to “ESPN BET's Meteoric Rise in 2024.” An excerpt:

Launched in November 2023, ESPN BET quickly gained users and high engagement, with average MAUs surpassing most Sports Betting apps, trailing only behind industry leaders DraftKings and FanDuel. This success is partly due to its investment in mobile ad networks. In 2024, 16% of ESPN BET's downloads were paid, in contrast to FanDuel's 6%, which relied more on word-of-mouth and its long-established position as a leader in the space.

Social media advertising on platforms like Facebook, Instagram, and Snapchat has been crucial to ESPN BET's early success in sports betting. Strong share of voice (SOV) correlations with downloads—0.84 for Snapchat, 0.73 for Facebook, and 0.73 for Instagram—indicate that targeted ads on these platforms significantly drove download growth.

If you read those paragraphs after coming out of a coma, you’d assume ESPN Bet is easily No. 3 in US sports betting, or is at least quickly rising.

Unfortunately for ESPN Bet, those numbers are totally at odds with its handle and revenue metrics. Both of those have only marginally improved since it transitioned from the Barstool Sportsbook brand in late 2023. It’s currently tracking as having only 3% of market share in the US by handle, and even worse by revenue (around 1-2% share).

Out of the six online sportsbooks that are operational in almost all of the online sports betting markets, ESPN Bet is No. 6. (A related aside: Sensor Tower data also isn’t capturing the rise of Fanatics Sportsbook, which is arguably the No. 4 sportsbook in the US now.)

Parent company Penn Entertainment has touted these types of metrics previously. It continues to be a fascinating data set that ESPN Bet is getting great results on engagement and monthly average users, but those results aren’t translating to a critical mass of spend on gambling.

In any event, if ESPN Bet can get all those people downloading and using the app to bet more, then they have something. But they haven’t proven that they can in the first year.

One more interesting data point: One of the reasons Penn did the deal with ESPN was to leverage the brand to organically grow the sportsbook. But ST points out that a lot of its success is due to ads.

The Challenger Series | New York Summit 2025

Are you navigating the complex US iGaming market as an iGaming operator founder? Learn from our community of industry-leading founders, investors, and entrepreneurs at the Challenger Series—for free! Gain insights on M&A, PR strategy, marketing, funding, and more.

Learn first-hand experiences from gaming founders on high-growth tips and network with the most influential investors, founders and leaders. Click here to register.

Also, I’ll be at the event in New York; message me if you want to catch up!

Gambling news today

Entain Once Again On CEO Hunt With Isaacs Out (Legal Sports Report): “Entain is again looking for new leadership after the company announced CEO Gavin Isaacs is stepping down immediately. Stella David will once again assume the role of interim CEO, according to Tuesday’s announcement. She served in the role from December 2023 until September 2024 when Isaacs formally took over. No reason was given for Isaacs’ sudden departure from the joint venture partner of BetMGM.”

Kalshi’s latest sports update: The prediction market platform will have three more major golf tournaments listed for trading (bets) tomorrow, as well as the Super Bowl winner for 2026, the WNBA champion, and more soccer and tennis markets. You can catch up on the latest updates in yesterday’s Closing Line and check out this week’s Event Horizon coming later:

Google Updates Its Gambling & Games Advertising Policy (Search Engine Journal): “Under the new guidelines, any content that provides direct links to online gambling or facilitates gambling services will be labeled as gambling-promoting. This clarifies that aggregator or affiliate websites must exclusively focus on providing information or comparisons about authorized gambling services. Anything beyond that scope will face restrictions.”

“The updated policy devotes considerable attention to social casino games. … Google considers breaches of social casino game regulations “egregious,” meaning they could result in immediate and permanent account suspensions.”

Casino and sports betting companies press for a win in Texas despite Senate opposition (Texas Tribune): “Undeterred by four years of sluggish progress and certain defeat at the Texas Capitol, the gambling industry is plodding ahead with its ambitious bid to legalize casinos and sports betting in a state with some of the most restrictive gaming laws in the country. For the third straight session, the Las Vegas Sands casino empire has deployed a murderers’ row of high-powered lobbyists to coax the Republican-controlled Legislature into authorizing “destination resorts” with casino gambling in Texas’ largest cities.”

Texas continues to be worth pressing for legalization because of:

a difficult environment nearly everywhere for passing online casino bills

a shrinking map for online sports betting legalization, especially with California appearing to be years away in a best-case scenario.

Good news/bad news for Nevada Super Bowl betting (Nevada Gaming Control Board): Sportsbooks in the state won $22.1 million on the Big Game, and held 14.6%; the gross revenue is a state record. At the same time, handle on the game was the lowest it has been since 2021.

Illinois senator wants to ban AI and cap deposits for sports betting (SBC Americas): “Sen. Bill Cunningham’s SB 2398 and SB 2399 have both been referred to the Senate Assignments Committee for debate after their respective first readings late last week. … The bills pull their main proposals directly from the debated SAFE Bet Act that was introduced by Rep. Paul Tonko and Sen. Richard Blumenthal last September.”

Two Oklahoma sports betting bills take small step in House (SBC Americas): “Rep. Ken Luttrell’s HB 1047 and HB 1101 were both passed by a 5-0 vote in an Appropriations and Budget Select Agencies Subcommittee on Monday and will now go before the House Appropriations and Budget Committee.”

Gambling With the Law: How SCOTUSblog’s Goldstein Risked All (Bloomberg Law): “Goldstein, the sole owner of his firm, was regularly wiring money from his law firm accounts to pay off gambling debts and illegally writing off the payments as business expenses, according to the indictment. He’d just missed the deadline to pay back millions of dollars to a California businessman who extended him a $10 million line of credit.”

Gambling newsletter roundup

Closing Line Consulting

Need help with gambling content, navigating the North American gaming industry, communications/PR, or research and analysis? I have a consultancy to help in gaming and beyond. Reach out if you want to have a conversation. Learn more about CLC here.

Want to sponsor The Closing Line?

Email dustin@closinglineconsulting.com for more information, and see more below.