The Takeaway: AGA's Numbers And The Future Of Online Gambling

TCL will offer analysis in the US gambling space in The Takeaway every Thursday.

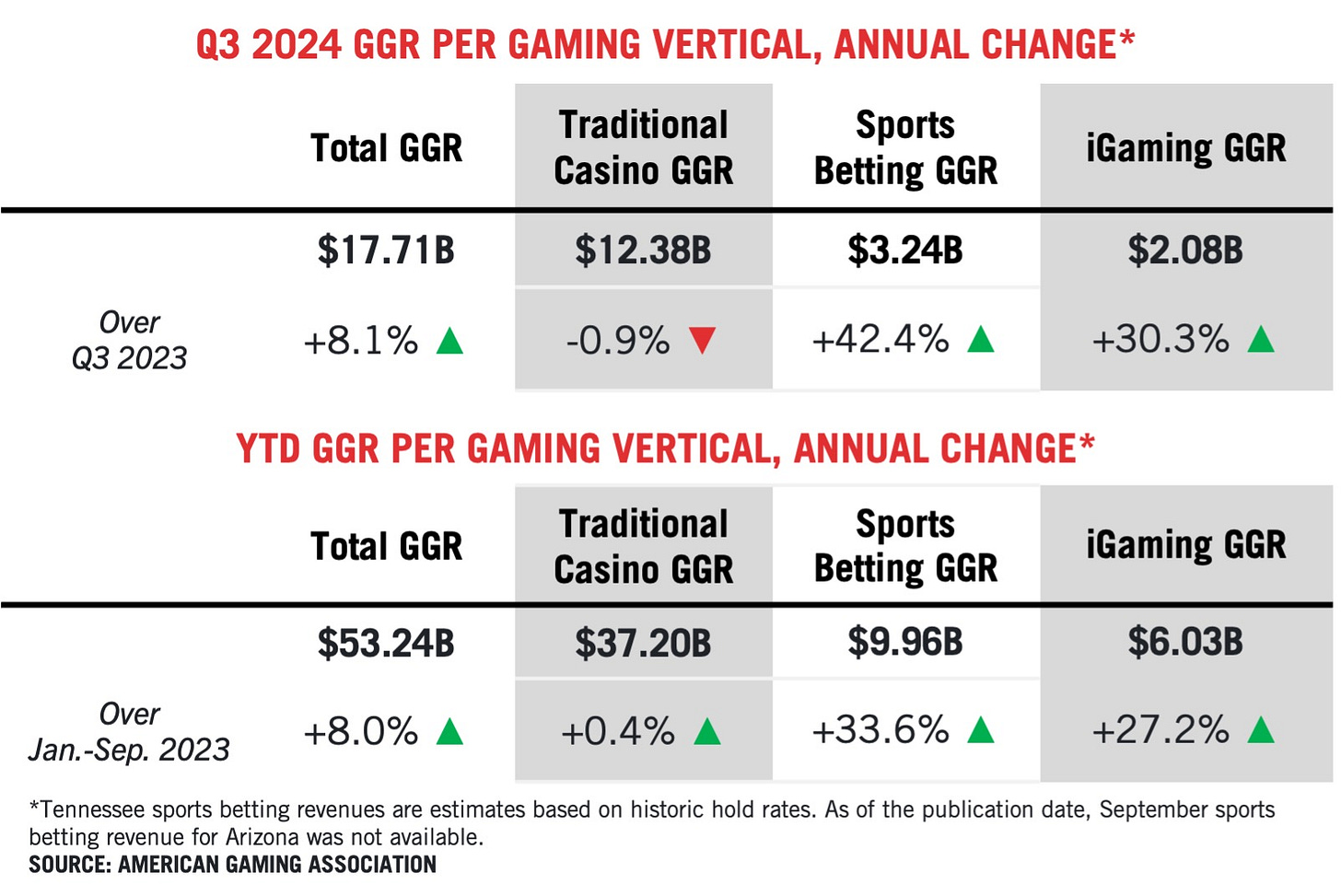

The American Gaming Association does a tremendous job each quarter of aggregating commercial gambling data. Here’s what they put together for Q3 (presser here, more data here.)

The topline takeaways for 2024 so far are:

Sports betting continues to grow a lot.

Online casino continues to grow a lot.

Land-based casinos are flat.

Let’s say you want to argue that online casinos in the few jurisdictions that have legalized them are hurting brick-and-mortar casinos, or perhaps hampering growth. I don’t buy that argument, but let’s assume for the sake of argument that’s correct, and consider the following:

Online sports betting and online casinos have generated almost $16 billion in GGR over the first nine months of this year! (The sports betting figure includes retail, but that number is small compared to how much of the activity comes online.) That’s not a figure that retail casinos are magically going to create out of thin air via improving their ongoing operations, or by convincing states to allow them to build more casinos, etc.

What’s wild to me is that some people look at those numbers and instead of seeing a massive opportunity for the future, they are wringing their hands about how it could hurt land-based operations. Shouldn’t you want to figure out a way to be in a higher-growth vertical? We have seen large casino companies in the US make the decision that they should be in that business, to great success. Look no further than MGM, Caesars and Rush Street (Rivers casinos).

Skill games from Toast

Are you interested in unlocking new revenue streams and acquisition/retention funnels with skill games? Toast is building real-money peer-to-peer strategy games specifically for companies in the US market, as well as around the world. Learn more at Toast's website or email connect@playtoast.com.

(Sidenote: I don’t at all blame tribal casinos for not wanting to adopt online gambling, unless they’re sure it’s what they want. History is littered with the US and state governments trampling all over Native Americans’ rights and land; I wouldn’t want to give up a monopoly on gambling, either. If they never want to be in the online gambling business, so be it, I respect that.)

Retail sucks, long live online

Think about things you like to spend money on in person, and if you’d rather do it online than go to a physical place.

I like to eat and drink in restaurants, and I like to go to events (concerts, sports, etc.) I can do without doing much else in person in terms of spending my money.

Take shopping, for instance. For the most part, I find shopping in person is a terrible experience. I am almost always disappointed by retail. Stuff might be out of stock, selection can be limited, I have to wait in a line for a checker or to check stuff out myself, and I have to navigate a cart through a maze of aisles and other similarly annoyed people. (My one exception is Costco, I love going there and getting the $1.50 hot dog.) Meanwhile, I can sit on my ass and buy anything in the world with free shipping from Amazon or elsewhere and get it delivered in a couple of days.

A super-niche example…I wanted to buy a microphone or mixer for my podcast (sorry for no podcast yesterday, by the way, I have been fighting a cold). I wanted it quickly, so I looked at stores where I live. The only options I could find were approaching $200, and some stores just didn’t have anything available). I just wasted a bunch of time and gas when I should have just bought it online from the jump.

This idea also hit me a bit with gambling when I was in Vegas for G2E. I am not a huge gambler, but I do like to play pai gow poker. There was only one table I could find at a property near where I was staying, and it was full a couple times I walked by. That’s a pretty terrible experience for me as a customer. And I am a bit old school, I like to sit a table, get a drink, hold the chips. However, I would also play online if you gave me the option! But I had no such option in Nevada.

That’s very anecdotal, of course, but think about of some of the blockers for retail casinos that don’t exist online — just getting there, for starters, and the limits of how many slots and games you can offer based on the size of the facility.

Online casinos aren’t necessarily perfect — I would love to see better UX’s there, too — but they offer an alternative to customers who may never visit a casino or who might play online more often than they would ever visit a property.

Anyway, I am not saying all retail casinos necessarily suck. But artificially trying to keep gambling in a retail setting in the year 2024 just doesn’t seem sustainable. Look no further than the dozens of online sweepstakes/social casinos that are serving the vast majority of states right now.

Back to the numbers

All that was pretty touchy-feely, so let’s go back to the AGA and the numbers. Here is the past decade of ALL commercial gambling revenue through 2023 dating back a decade.

Ignoring the Covid drop, that’s a pretty shallow but steady trendline up for land-based casinos. If online casinos were badly hurting retail on a state and/or regional basis, wouldn’t we expect to see more disruption?

If you don’t buy that zoomed-out view, again, I got into this at the state level for the three biggest states. The bigger takeaway is that each state is a snowflake regarding its commercial casino operations. There can be myriad things that impact casino performance at the state or operator level. For instance, let’s zoom in on Q3 performance from the AGA:

Michigan has online casinos, but retail revenue was up in the quarter. There were 13 states that saw retail casino operations take a hit in the quarter; three of them have legal online casinos.

Here’s the most interesting data point from the quarter: Delaware moved its online sports betting and casino from 888 to Rush Street (Bet Rivers brand) at the start of the year. Online casino revenue immediately increased significantly with that launch, tripling or quadrupling GGR over the same months in 2023. So if we believe that more online casino activity is hurting Delaware’s retail operations, we’d expect to see that show up in the numbers, right?

After the first two quarters of this year saw a small decline in retail revenue (Q1 and Q2), Delaware saw the most growth of any state in retail gaming other than Virginia in Q3, per the AGA. Lots of online growth, not much impact to retail. Sounds familiar.

Finally, here’s full-year 2023, in which retail casinos set a record in GGR with 3.3% growth YoY. Per the AGA: “While traditional casino gaming’s rate of annual growth slowed compared to 2022, it outpaced the years leading up to the pandemic.”

Of the five tracked states that have online casinos, retail was up in three of them. Six states that don’t have online casinos saw revenues decrease.

Whether you think about numbers or vibes, the future of regulated gambling in the US should be online. It’s just a matter of how long and painful the process of getting there is going to be.

Closing Line Consulting

Need help with gambling content, navigating the North American gaming industry, communications/PR, or research and analysis? I have a consultancy to help in gaming and beyond. Reach out if you want to have a conversation. Learn more about CLC here. For sponsorship inquiries, email dustin@closinglineconsulting.com.