The Takeaway: Nothing Is Gambling, Everything Is Gambling

Kalshi CEO told Axios: "I just don't really know what this has to do with gambling."

This isn’t a post entirely about Kalshi, I promise. OK, it’s mostly about Kalshi. But we’re going to use Kalshi as a jumping off point, even though Kalshi is more of a symptom than a cause of where we find ourselves today in the US gambling landscape.

Kalshi CEO Tarek Mansour spoke with Axios recently about how sports event trading very much isn’t gambling. I’ll let you read the whole thing if you’re interested, but here’s the key bit:

"I just don't really know what this has to do with gambling," he said at an office in Washington. "If we are gambling, then I think you're basically calling the entire financial market gambling."

The idea that Mansour that doesn’t “really know what his platform has to do with gambling” kind of defies belief. It’s a bit of gaslighting, but since Kalshi’s future hinges on people thinking and deciding it isn’t gambling, I get why Kalshi is going heavy with this kind of messaging. But consider:

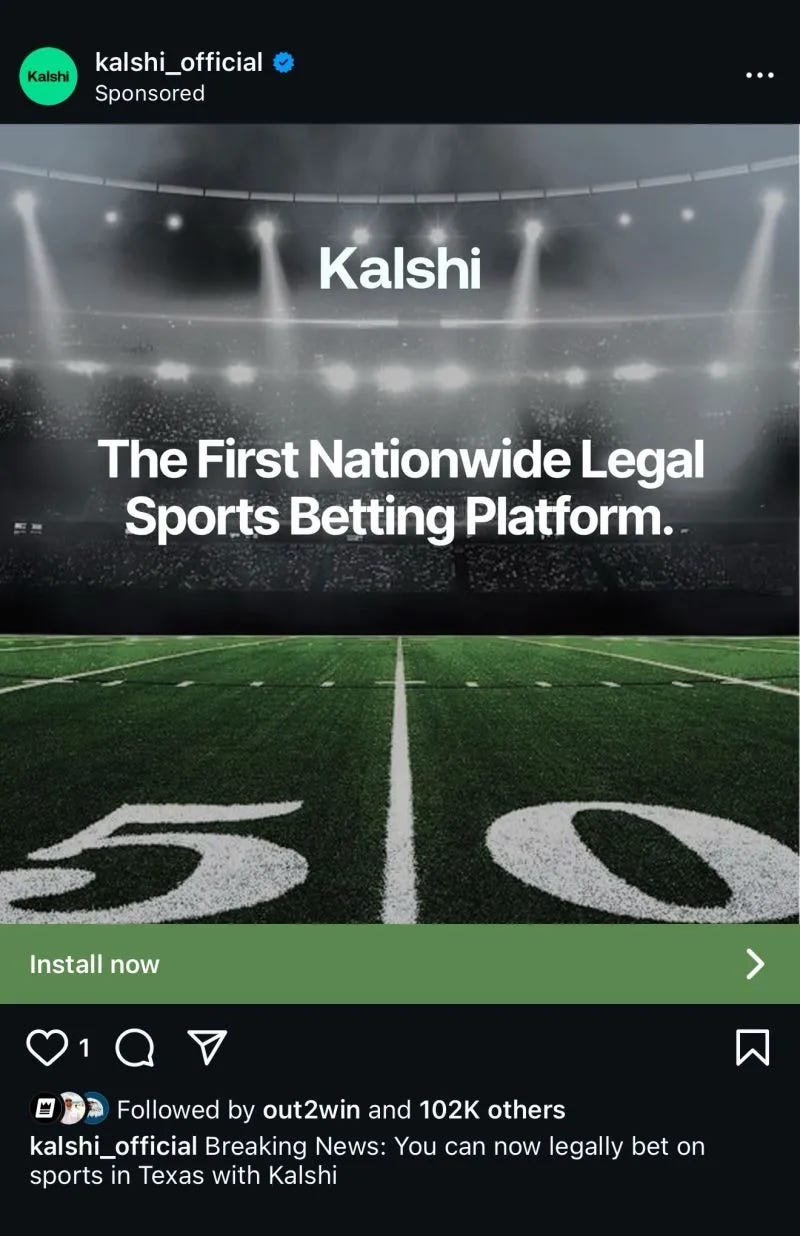

For many months — both pre- and post- the launch of sports event trading, Kalshi was marketing its product as gambling. Kalshi itself was promoting posts on social media about how it was legal sports betting!

I did a roundup of many of those instances over at The Event Horizon:

I could go on for days pointing out more examples, but it’s kind of beside the point. I am mostly preaching to the choir here, and the people who believe in their hearts that this is not gambling are beyond my reach.

Kalshi is really just the latest example of people/industries making some variation of the arguments:

“If this is gambling, everything is gambling!”

“This isn’t gambling because of x”

All of this is being done increasingly to find ways to operate “creatively” outside of the regulated gambling space. Kalshi didn’t invent any of this, they’re just the latest — and potentially most disruptive — example.

Let’s take them one at a time:

‘If this is gambling, everything is gambling!’

I have been having versions of this argument for a decade. People yelled at me for saying that daily fantasy sports 1.0 was gambling. The idea that the original version of DFS might be considered “gambling” almost seems quaint now.

The argument goes like this: If you say this thing is gambling, then where’s the line? Then everything is gambling. Investing, leaving a job, the simple act of walking across the street, etc. are all gambling. This argument can be used to validate all sorts of products that toe the legal line of what is gambling and what is not.

This is all a bit of a straw man. I think we all understand that every decision we make in life comes with some amount of risk, either large or minuscule. That does not inherently make everything we do “gambling.” Gambling generally implies betting on something that is out of our control. Most of the decisions we make that have risk, we also have some measure of control over them.

Let’s get into two specific examples that people like to use, including Mansour in Axios. These may seem obvious to a lot of you, but I think it’s worth writing it out.

The stock market: Can you use the stock market as a gambling instrument? Absolutely. Some people use it exclusively in that way. Trading stocks has a lot of the elements of gambling: outcomes are uncertain, your money is at risk, you could be betting if a company will succeed or fail, hit targets or not, etc.

But the stock market is also fundamentally different from gambling in a few key ways. This is the most important bit: when you buy stock, you own an actual piece of a company. And the stock market writ large and diversified portfolios are historically positive over long-term horizons (longer than the last few weeks, at least).

Insurance: Again, there are absolutely elements of gambling in insurance. You are, at core, betting on bad outcomes. You buy insurance in case you die, your house burns down, you wreck your car, etc.

But that’s less gambling and more hedging against catastrophic outcomes. If you die, you want your family to have money. Most people would not be able to financially recover from the destruction of their house without insurance. Gambling? Sure. But there’s absolutely a legitimate reason to insure things to make sure your life doesn’t end up in shambles.

Which is where most sports event trading kind of falls apart to me. There are actual things with lots of real-world hedging utility cases listed on Kalshi! How much they are being used for hedging vs. pure speculation (ie gambling) of course is up for debate, although I am fairly certain it is more the latter. But even so, there is at least a decent argument for their existence.

Who is going to win today’s game between the Philadelphia Phillies and the San Francisco Giants? You’re really going to have to twist yourself into a pretzel to come up with a realistic hedging/economic use case for the outcome of most single games. This is just people betting on an outcome.

Funny enough, the best use case is probably — wait for it — sportsbooks who want to lay off risk, or profit from trading. But I digress, and that’s probably a topic for another day.

There are actually far worse examples of this at Kalshi, even outside of sports event trading. What announcers are saying in a college basketball game? What’s the economic utility of this?

There was also recently a mention market for former President Joe Biden on a speech he gave:

Here are some more words you could have traded on:

If you’re trying to argue that Biden saying “malarkey” or not is a serious financial instrument, please find god.

‘This isn’t gambling because of x’

I’ll preface the following with this: I am mostly staying out of the business of calling balls and strikes on what is legal and what is not. That’s going to be up to policymakers and regulators and judges and lawyers. The default is things are legal until someone says/proves they are not; for better or worse, that’s kind of the world we live in in the US gambling industry.

Here are the best examples that readers of this newsletter will be intimately familiar with:

Prediction markets: “Legal because the Commodity Futures Trading Commission has the say over event contracts in the US. State laws don’t matter.” (They may be right at the end of the day!) We’ve gone over why this is just gambling, so I will not beat that horse even more.

Sweepstakes casinos and sportsbooks: “We are legal because we follow sweepstakes laws.” Many of them do. And many of them do follow the spirit of being a sweepstakes (although I’d argue some of them do not.) What existing gambling laws say about them is in many cases very much up for debate. But there’s also a reason why the odds at sweepstakes sportsbooks are offered alongside odds at regulated and offshore sportsbooks. You can use these products to gamble, if you choose to. It just may very well be legal.

Fantasy pick’em: “We are legal because of fantasy sports laws, the UIGEA and game of skill laws.” Honestly, pretty good argument on most fronts at this point. Two companies in the space are now unicorns (valued at more than a billion dollars) — PrizePicks and Underdog. Who am I to argue? But, at the end of the day, these are just parlays on player props. it’s unquestionably gambling, it just happens to be legal gambling in most of the jurisdictions they serve, at least until further notice. There’s definitely skill involved. But there’s also skill in lots of types of gambling (sports betting, poker, etc.)!

I’ll close with this. I feel like we used to be able to have honest conversations about what is gambling and what is not. It feels like it’s much harder for that to happen now. When I go golfing with friends, I like to gamble on whether I can beat them. I guess now that’s just a game of skill and I should say I am not gambling.

The watering down of what is gambling is unquestionably a slippery slope. People like to say there’s all this harm being created by the regulated sports betting industry — and I won’t deny there is harm from expanded sports betting. But have we really stopped to consider this huge swath of products that are being marketed to people as “not gambling?” I feel like we haven’t even scraped the surface. If a large cohort of people become convinced that sports event trading at Kalshi et al isn’t gambling and they are just “investing,” I’d argue that’s a terrible outcome.

Why is this happening? The regulatory and legislative landscape around regulated gambling and quasi-gambling products incentivizes finding ways to operate outside of truly regulated constructs. Do I want to go beat my head against a wall by paying a 51% tax rate to offer regulated sports betting in New York and get crushed by DraftKings and FanDuel? No thanks, I’ll find some other way to skin that cat. I want to offer a legal online casino, but I can only do it in a handful of states? Pass.

That’s the calculus in front of companies wanting to contest the online gambling industry in the US right now. And it’s hard not to blame anyone for pursuing alternative paths.

Gambling news roundup

'Stop betting on our children:' Gambling led to violence at games, officials say (Cincinnati Enquirer): “Gun violence at youth sports games like peewee football has been spurred on by gambling, according to Cincinnati City Councilman Scotty Johnson. At a joint meeting between Cincinnati Public Schools and City Council Wednesday, the topic was safety at youth sporting events. These youth leagues often rent facilities from Cincinnati Public Schools to hold their games, and the district is reporting theft, vandalism and gun violence.

Johnson, who is a former Cincinnati police officer, said that part of the reason is ‘the ridiculous amount of money that's being bet on these youth games.’ He said bets of up to $5,000 are being placed.”

I don’t even know what to say. But it is an example of why sports and betting can be a powder keg, even when the regulated industry has nothing to do with it.

Massachusetts Regulators Address ESPN College Game Day Host’s Comments About ‘Risk Free’ (Sports Betting Dime): “The Massachusetts Gaming Commission held an adjudicatory hearing today for 2024 comments made by ESPN College Game Day Host Rece Davis about a sports betting pick being “risk-free investing” and not gambling. … The MGC will take action at a later date, which could result in a fine, or the worse case scenario of PENN Entertainment losing its sports betting license in the commonwealth. Based on previous action taken by the MGC, a fine for PENN is the likeliest outcome.”

Crypto Casino Founder Richard Kim Arrested After Gambling Away Investor Funds (CoinDesk): “Richard Kim, the founder of crypto casino Zero Edge, was arrested on Tuesday following allegations that he had gambled away investors' funds. According to an FBI complaint filed on Tuesday in the Southern District of New York, Kim ‘fraudulently induced investors to invest in Zero Edge, a cryptocurrency technology company he founded, and then misappropriated millions of dollars in those investors’ funds.’”

Light & Wonder acquires 20% stake in European slots studio (SBC Americas): “Light & Wonder is continuing to bolster its portfolio of properties with an investment in a European slots studio. The slots machine maker announced on Thursday a 20% equity investment in Bang Bang Games providing the London-based slots studio with access to North American gaming markets. Light & Wonder has invested in Bang Bang as part of its Spark program, which provides a platform for emerging studios that operate without a remote gaming server.”

Aussie lottery broker confirms cyber attack (Cyber Daily): “On Friday, 11 April, a threat actor going by the name ‘Ponce’ listed TheLotter Australia on a popular hacking forum, claiming to have exfiltrated data belonging to 201,617 customers. … ‘As part of our commitment to transparency and customer trust, I can confirm that the incident involved a limited leak of internal game logs used by our audit systems,’ a company spokesperson told Cyber Daily.”

The Lotter is one of a variety of lottery couriers that provide lottery tickets via online sales in some US states.

There’s a new sports betting news (and future affiliate) site that launched today, with some veterans of the industry doing the content. More on InGame here.

Gambling newsletters

Want to sponsor The Closing Line?

You can email dustin@closinglineconsulting.com for more information.

There's gambling, and then there's gambling.

Slot machines are negative-sum, mindless entertainment.

Prediction markets may be gambling in the commonsense dictionary sense of the word (legalisms aside), and they may be zero-sum in the narrow sense of monetary transfers, but they have a positive externality (signal).

So it's not crazy to say prediction markets should be treated differently than, say, casinos.

I am not a lawyer and I doubt existing laws take these distinctions into account -- but perhaps they should.

Love the Kalshi analysis ... and the spot-on refutation of the "investing is gambling" notion ... and the open discussion about where the gambling line should be drawn.

Puzzled by the idea that legal sports betting has nothing to do with $5,000 bets on youth games and related crime. The billions of dollars spent by OSB operators to glorify sports betting have gone a long way toward creating that world, have they not?